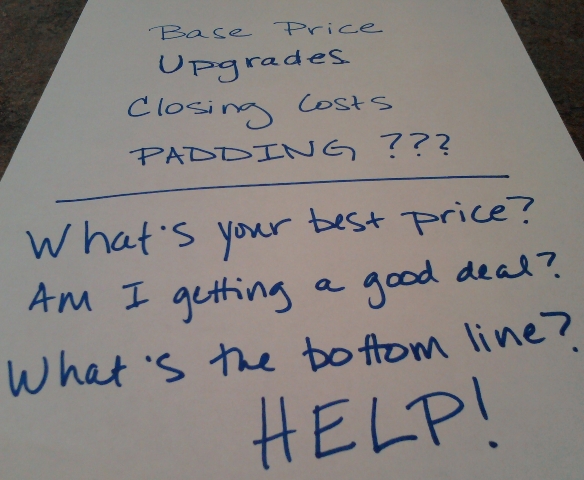

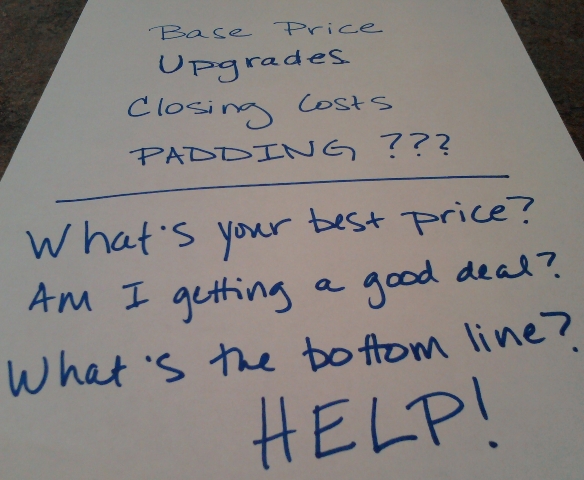

One of the biggest hurdles we have as salespeople are conversations about closing costs. Most of our competition offers the buyer a package which includes the Seller paying for all closing costs. I’ve even heard $8,000 in closing costs advertised by the competition. Well, where do closing costs come from?

Closing costs include a multitude of fees from Home Owner’s Association Fees to Title Company Fees and the cost of a Survey of your home and home site. This is the cost of buying a home. Most builders’ contracts have a list explaining which of the closing costs the Buyer pays and which are the responsibility of the Seller. What is confusing is that most other builders talk to Buyers about contributing to the Buyer’s closing costs.

At Antares Homes we begin with a Value Base Price (A) on our homes and then a buyer can add upgrades and options (B) to the price of the home at the Selection Studio. After this is completed we can often add the Buyer’s closing costs (C) to the final price. A+B+C=Your Mortgage!

What other builders are doing is A+B+C+D (padding for negotiating) = Starting Asking Price. How do you find the Bottom Line Price? And how do you know they won’t lower it even more for the next buyer after you??

We feel that our practice of rolling the closing costs into the loan at the end of the process is the fairest option. You are only paying for the closing costs generated by the sale of the home you are purchasing and not some round number with extra padding that another person has chosen for you.